Sharing is caring!

In 2002, the Chinese factories were primarily churning out low-cost goods such as sneakers and T-shirts for consumers around the world when a lethal, pneumonia-like virus known as SARS emerged.

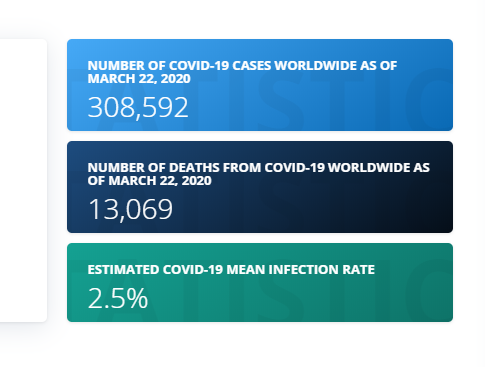

Seventeen years later, another deadly virus hit China and its effects can be seen throughout the world even. The world’s most populous and the second-largest economy of the world is experiencing a complete lockdown of its offices and economy. International companies that rely heavily on the factories in China to make their products or depend on Chinese consumers for sales are already warning of costly problems ahead. The novel coronavirus (COVID-19) has hit China badly, and the world too. The world is already on the brink of a global recession.

The epidemic and draconian measures designed and “forced” on the Chinese population delivered an unprecedented shock that is now being replicated around the world. Malls, educational institutions, offices, and literally everything is under the lockdown.

According to a conservative forecast from Oxford Economics, the economic growth of China is expected to slip this year to 5.6 percent, down from 6.1 percent last year. This would, in turn, minimize global economic growth of the year by 0.2 percent, to an annual rate of 2.3 percent that is the slowest pace ever since the global financial crisis a decade ago.

According to the National Bureau of Statistics, retail sales plunged 20.5 percent during January and February over the same period in 2019. Fixed asset investment fell by nearly 25 percent and industrial output was down 13.5 percent. All these three points were found much weaker than the expectations of analysts. Furthermore, the decline in industrial production was the sharpest contraction on record. To add to this, the data for March 2020 could be even worse.

The ruling Chinese government is pushing hard to get the economy back to its feet by encouraging companies to make a return to work, albeit under stringent conditions that are aimed at preventing an upsurge in the number of coronavirus cases.

It is expected by the National Bureau of Statistics that the Chinese economy may improve in the second quarter of the year, with companies returning to work and as different policy measures, including but not limited to liquidity injections, interest rate cuts, and cuts to taxes and fees, filter through the economy. However, things may not be as smooth as everyone wants them to be as the global spread of the virus and a spike in Chinese unemployment (that will depress consumer spending) will hold back exports even as factories return to normal operations.

The unemployment rate of China has shot higher, up to 6.3 percent in February from 5.2 percent in December.

Ajay Dubedi, the CEO and Founder of Cloud Analogy, remarked that the spread of the coronavirus in almost every country of the world means global demand will be heavily impacted and stop abruptly. He added the supply chains across the world will still be broken and damaged when factories and companies around the world suspend operations. The CEO of Cloud Analogy further remarked retail sales are not likely to improve any soon and there is a possibility that a second outbreak of the novel coronavirus may hit China again due to the urgent need for the country to restart its economy.

Ajay also commented that the Chinese government is indeed trying to pump up the economy by including fiscal and monetary measures to further increase government spending, reduce borrowing costs, and ease the tax burden but it cannot flood the market with excessive liquidity to avoid pushing consumer prices even higher.

The CEO of Cloud Analogy also said it is too little and too late from the Chinese government to take corrective actions as China’s foreign exchange reserves have fallen, current account surplus has dropped, and debt has surged. The massive hike in pork prices due to swine fever has also pushed inflation higher and it along with many other factors have made it extremely difficult for the Chinese government to restore economic growth with cheap credit and heavy borrowing.

After SARS, China had to undergo several months of hardships and economic contraction but then it rebounded dramatically. That might happen this time too. The only thing that is certain is this: Whatever happens in China will be felt globally.

Deepali Kulshrestha

Salesforce Certified Developer | Delivery Management Head

Deepali, a certified Salesforce Advanced Administrator and Salesforce Developer and CSPO Certified at Cloud Analogy, is a successful name in the industry circles when it comes to the delivery of successful projects with end-to-end testing. Deepali is a globally-renowned industry stalwart when it comes to managing Operations & Delivery Planning in driving Business Performance Management.Hire the best Salesforce Development Company. Choose certified Salesforce Developers from Cloud Analogy now.