Sharing is caring!

If you’re an insurance broker, you know one thing to be true:

Leads are never the issue. Managing them is.

Leads come from many sources: referrals, WhatsApp, email, cold calls, LinkedIn, website forms, events, and sometimes random “call me back” messages at 11:56 PM.

But the tough part is this:

- You miss some leads.

- You follow up late.

- You forget to renew.

- You lose a valuable client to a quicker competitor.

- You juggle too many spreadsheets and reminders.

- And just like that, revenue slips away.

Now, imagine if every lead was captured automatically, prioritized instantly, and followed up before you even thought about it.

That’s exactly what AI-powered lead management does.

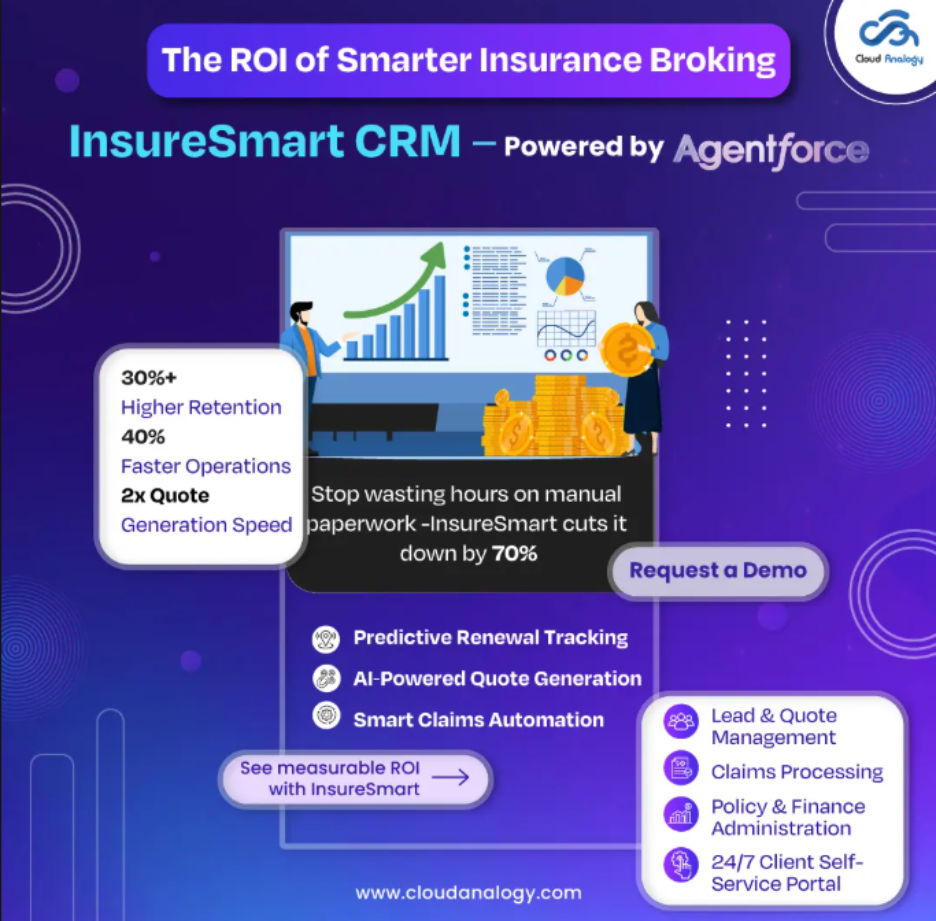

This is where InsureSmart CRM transforms the experience for insurance brokers, whether you’re dealing with retail clients, corporate accounts, group health, motor, fire, or specialty lines.

Let’s break it down in a simple way.

Why Traditional Lead Management Fails for Brokers?

Most insurance brokers still rely on:

– Excel sheets

– Sticky notes

– WhatsApp chats

– Manual calling lists

– Separate files for each policy

– And sometimes, just memory

The result?

Leads get lost.

Follow-ups get missed.

Reminders get ignored.

Conversions drop.

Even top-performing brokers admit their workflow gets messy fast, especially as leads start to pile up. The real challenge isn’t about finding leads. It’s about managing them quickly enough to convert before someone else does.

Here’s where AI comes in and improves your process right away.

What AI-Powered Lead Management Does?

Let’s keep things straightforward.

AI in InsureSmart CRM does three things very well:

1. It captures every lead immediately.

No more:

– Lost WhatsApp inquiries

– Missed email leads

– Forgotten callbacks

– Scattered spreadsheets

InsureSmart automatically collects leads from:

– CTI/Calls

– Website forms

– Landing pages

– Referral forms

– Social campaigns

– Offline sources

Every lead goes into one clear dashboard.

No duplicates.

No confusion.

No chasing.

2. It scores and prioritizes leads for you.

AI looks at:

– Lead behavior

– Interest level

– Previous interactions

– Policy type

– Probability of conversion

Then it tells you:

– “These 5 leads are POTENTIAL. Call now.”

– “These 8 leads are warm. Follow up today.”

– “These leads need nurturing.”

Instead of guessing who to call first, you get a ready-made priority list.

This alone helps brokers close leads twice as fast because the focus is on clients ready to buy.

3. It automates follow-ups, which is a major conversion killer.

Let’s be honest.

Most leads don’t convert due to lack of interest.

They don’t convert because:

– Brokers forget to follow up.

– Follow-up happens too late.

– Follow-up is inconsistent.

– Follow-up relies on manual reminders.

In InsureSmart CRM, follow-ups happen automatically:

– Auto WhatsApp responses

– Auto reminders

– Auto follow-up workflows

– Auto policy education messages

– Auto nudges for documents

– Auto renewal reminders

Imagine the time savings.

Imagine the consistency.

Imagine the conversions.

Follow-up drives sales.

AI makes follow-up impossible to miss.

How AI Helps Insurance Brokers Convert Twice as Fast?

Let’s look at real-world outcomes insurance brokers see with InsureSmart CRM.

Faster Response Time = Higher Conversions

AI reacts instantly, even when you’re in a meeting or asleep.

- Lead inquiries get auto-acknowledged, which builds trust.

- Clients feel valued, and you stay engaged in the conversation.

Zero Missed Leads Equals More Business

- Every lead gets tracked.

- Every interaction gets logged.

- Every conversation is accessible.

No lead goes cold because you forgot.

Better Client Engagement Equals Immediate Trust

AI sends:

- Policy details

- Document checklists

- Premium breakdowns

- Reminders

- Follow-up notes

This creates a smooth journey for the client.

Predictive Lead Scoring Equals Smarter Selling

You stop wasting time on leads that won’t move.

You focus on leads that will close.

Brokers report closing more policies in less time because AI reorganizes their workflow.

Real-Time Pipeline Visibility

You always know:

– What’s stuck

– What’s at risk

– What’s closing soon

– Where delays are happening

– Which policies need quick attention

This leads to better planning and faster deals.

Automated Calling Queues

Agents no longer think about who to call next.

The system decides.

They execute.

Conversions happen.

Why InsureSmart CRM is the Perfect AI Lead Engine for Brokers?

There are many CRMs out there.

But insurance brokers don’t need a generic CRM.

You need something designed specifically for:

– Policy types

– Renewals

– Claims

– Documents

– Compliance

– Insurer coordination

– Client servicing

– Multiple product lines

InsureSmart CRM is built just for that.

– AI-Powered Lead Management (100% automated)

From inquiry to qualification to follow-up to conversion.

– Predictive Renewals (Powered by Agentforce when applicable)

Know which clients are likely to renew.

Know who needs attention.

Know where the premiums are stuck.

– One-Click Documentation

Say goodbye to document chaos.

– Zero Manual Errors

Every detail gets recorded automatically.

– Real-Time Policy Tracking

Clients stay informed.

You stay stress-free.

– Omnichannel Lead Capture

All channels.

One dashboard.

Let’s Make It Real: A Before-and-After Comparison

Before AI / Traditional Workflow

– Leads lost on WhatsApp

– Forgetting renewal follow-ups

– Manual data entry

– Paper-based processes

– Delayed claim status updates

– Scattered client information

– Slow response time

– No visibility on what to prioritize

– Every lead auto-collected

– Smart scoring shows hot leads

– Auto follow-ups 24/7

– Ready-to-use workflows

– Real-time client tracking

– Zero manual errors

– Faster conversions

– Higher client satisfaction

– Better upsell and cross-sell opportunities

It’s not just an upgrade.

It’s a complete transformation.

What Does Twice as Fast Conversion Actually Look Like?

Here are the numbers brokers typically see:

– 60% faster response time

– 45–70% improvement in follow-up consistency

– Twice as many renewals secured on time

– 40% more accuracy in lead qualification

– 10–20 hours of weekly manual work eliminated

When you improve these areas, conversion naturally doubles.

AI removes the biggest barriers:

– Delays

– Errors

– Confusion

– Follow-up gaps

– Manual dependency

When everything runs smoothly, clients feel valued – and they convert faster.

Is AI the Future of Brokerage?

Yes, and it’s already happening.

Most top brokerages worldwide are moving to:

– AI-driven lead engines

– Automated renewal systems

– Predictive client behavior models

– Proactive servicing workflows

This isn’t just nice to have anymore.

It’s becoming essential for survival.

The brokers who embrace AI today will be the ones leading the market tomorrow.

So, Should You Switch to AI Lead Management?

If you’re tired of:

– Losing leads

– Late follow-ups

– Messy spreadsheets

– Manual errors

– Scattered communication

– Slow renewals

– Low visibility

– High workload

Then yes, you should definitely consider it.

Because the truth is simple:

Clients move quickly.

Insurance markets move fast.

Your brokerage should too.

Final Thoughts: If Your Leads Are Growing, Your System Must Adapt too.

AI isn’t here to replace brokers.

It’s here to support them, speed them up, and help them close more business with less effort.

InsureSmart CRM gives you:

- – AI precision

- – Automation power

- – Insurance-specific workflows

- – Broker-friendly tools

- – Salesforce-backed stability

It’s everything a modern brokerage needs to operate smoothly, sell faster, and grow smarter.

If doubling your conversions sounds appealing…

Book your demo of InsureSmart CRM today.

Your brokerage will never work the same way again.

Frequently Asked Questions (FAQs)

Automatic lead capture records every enquiry instantly from all channels into a CRM without manual entry. This reduces missed opportunities.

It collects leads in real time, assigns them immediately, and eliminates manual errors. This ensures that no buyer enquiry gets lost or delayed.

Yes. BuilderSmart CRM captures leads from WhatsApp, calls, ads, website forms, and offline sources all in one dashboard.

Leads get scattered across WhatsApp, calls, spreadsheets, and emails. This causes delays and missed follow-ups.

Yes. Quicker response times, clean data, and consistent follow-ups lead to higher conversions and less lead leakage.