Sharing is caring!

Summary

- Salesforce has a strong balance sheet and should not face a problem fueling growth via Mergers and acquisitions’ activities. During this bearish market phase, there should be plenty of opportunities for acquisition before the CRM giant.

- 93 percent of Salesforce’s revenue is deferred and under long-term contracts. Short-term results for the global cloud computing company should not be unduly impacted by the market downturn.

The economic downturn may have hit the cloud software market but Salesforce has managed to fare better than many other Fortune 500 companies. Bullish analysts say Salesforce will stay strong even during the challenging times ahead of the industry.

The upbeat view is that acquisitions by Salesforce have helped the CRM giant expand from its roots in customer relationship management software into eCommerce, marketing, and application development. The leader in software-as-a-service (SaaS) is positioned well as businesses are increasing spending on digital transformation projects.

Strong Record During Recession

Despite the likelihood of recession ahead of the industry, Salesforce is in good shape to withstand the ‘storm.’ The CRM giant has a strong balance sheet and demonstrated a strong record through the last two recessions.

Marc Benioff, the co-founder of Salesforce, had remarked that he and Parker Harris built a business model that was designed to transcend challenging market situations so that their company would have durable growth over time regardless of the crises. The strength of Salesforce is evident from the fact that it demonstrated unparalleled strength in the financial crisis of 2009-2011.

Salesforce is likely to persevere throughout the economic downturn primarily because of a high level of deferred revenue and multi-year contracts. It is interesting to note that a whopping 93 percent of its revenue is deferred that provides tremendous visibility into the future.

Undoubtedly, this is a critical aspect of the relationships that Salesforce has with its customers. The deferred revenue is already under contract and would translate into better future results than other CRM providers that offer short-term subscriptions.

Core Business Strength

On February 25, Salesforce reported fourth-quarter adjusted earnings of 66 cents a share, which included a 3-cent investment gain, down 6 percent from a year earlier. The revenue of Salesforce climbed 35 percent to $4.85 billion, including the acquisition of Tableau Software. Analysts are of the view that the CRM giant is likely to report earnings of 56 cents on sales of $4.75 billion for the period ended on January 31.

Salesforce remarked its current remaining performance obligations (or CRPO bookings that are an aggregate of deferred revenue and order backlog) rose 26 percent to $15 billion. This topped the estimates of analysts of 21 percent growth to $14.41 billion.

Salesforce had set a goal of $20 billion in annual revenue by 2022 before the Tableau acquisition.

In a daily bar chart of CRM, it can be seen how prices broke the lows of August and October in the March plunge. Earlier this month, prices bounced and then made a retest or retracement. Since the middle of March, the On-Balance-Volume (OBV) line has been bottoming out.

This suggests that CRM sellers are no longer being very aggressive. Last month, the Moving Average Convergence Divergence (MACD) oscillator crossed to the upside for a cover shorts buy signal and it continues to improve this month.

The above Figure Chart of CRM demonstrates the longer-term uptrend over the past three years and suggests that there may not be new highs, but things are indeed going in the right direction.

M&A Activity

Powered by a unique combination of organic growth and Mergers and acquisitions (M&A). Salesforce has been able to consistently grow its revenue. Critics would like to assume that M&A activity for Salesforce will be curtailed in the times to come but the CRM giant has strong free cash flow margin of 21 percent and close to $8 billion in cash and short-term investments, which suggests the complete opposite.

Interestingly, the depressed market may lead to plenty of opportunities for acquisitions by Salesforce.

Conclusion

Salesforce has managed to survive two previous recessions. The company is perceived as a cash machine, primarily because of its SaaS business model that has been replicated by many software companies with mostly very good results. Salesforce is likely to continue its dominance and achieve its stated goal of doubling revenue by 2024.

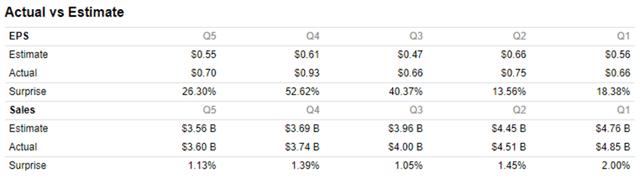

On top of this, 93 percent of Salesforce’s revenue is under contract and deferred. Therefore, there would be no or marginal deterioration in results during the pandemic. Salesforce has not withdrawn its guidance for 2021 yet and this is indeed a good news for the investor community. The CRM giant has a very good record for meeting analysts’ estimates as shown in the table below:

With its free cash flow margin and strong revenue growth, Salesforce is all set to turn the tables again and not only survive but prosper in the recession possibly ahead of us.

Suraj Tripathi

Salesforce Consultant | Solutions Engineering Head

"Suraj Tripathi, a certified Salesforce Principal Consultant of repute, is a wonderful mentor and leader. A certified Salesforce Architect and a 7x Salesforce Certified Platform Application Developer by passion and profession, Suraj has rich experience in languages such as Aura, HTML, Angular, Bootstrap, APEX, and JavaScript. With more than five years of expertise in Salesforce Development, Suraj has worked on more than 50+ projects out of which 20+ projects were related to Salesforce Integration, Writing Triggers, Batch classes, VisualForce pages, and Aura Components.Hire the best Salesforce Development Company. Choose certified Salesforce Developers from Cloud Analogy now.